July 27, 2023: The Bank of Canada has unveiled its schedule for policy interest rate announcements, the quarterly Monetary Policy Report, and other significant financial disclosures for the year 2024.

The announcement also reconfirms the dates for the remainder 3 policy interest rate announcement for the current year 2023.

Skip to Content:

Key 2024 Dates for Interest Rate Announcements

The Bank has disclosed the following dates for the release of interest rate decisions in 2024. Scheduled dates to publish monetary reports are marked with ‘*’:

- Wednesday, January 24*

- Wednesday, March 6

- Wednesday, April 10*

- Wednesday, June 5

- Wednesday, July 24*

- Wednesday, September 4

- Wednesday, October 23*

- Wednesday, December 11

Alongside the interest rate announcements, the Monetary Policy Report will be published concurrently on the following dates in 2024: January 24, April 10, July 24, and October 23

Policy Interest Rate Announcements in 2023 so Far:

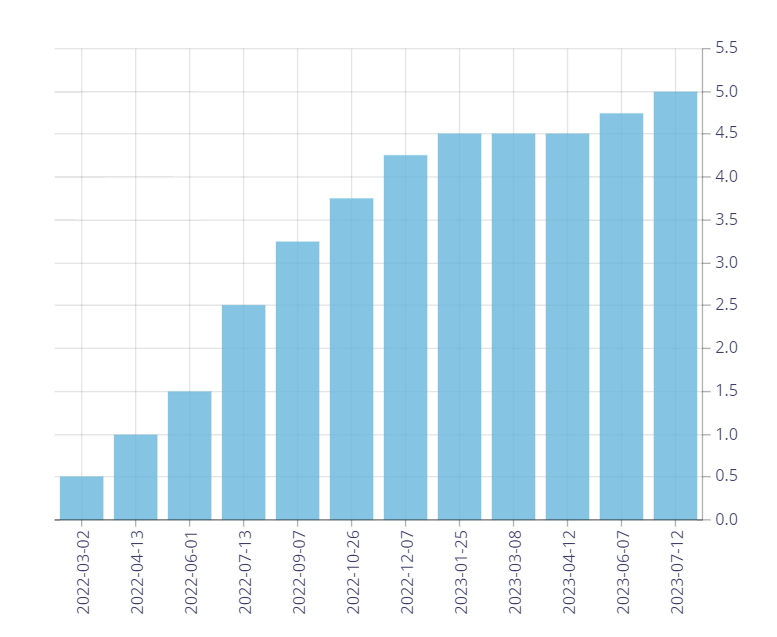

Following image shows the trend of Policy Interest Rates set by Bank of Canada in 2023 so far. Currently, the interest rate is sitting at 5%, up 50bps since the start of 2023.

It is also notable that the interest rates have doubled over the period of 1 year, to 5% from 2.5% in July 2022.

Remainder of 2023 Schedule Reconfirmed

The Bank has reconfirmed the remaining interest rate announcement dates for 2023, as follows:

- Wednesday, September 6

- Wednesday, October 25*

- Wednesday, December 6

As with 2024, the Monetary Policy Report will be published alongside the interest rate announcement on October 25, 2023. All interest rate announcements will occur at 10:00 (ET).

Other Significant Disclosures

In addition to the interest rate announcement schedule, the Bank of Canada has published its schedule for the release of the Business Outlook Survey, the Canadian Survey of Consumer Expectations, and the Financial System Review. These disclosures provide valuable insights into the financial health of the nation and are key indicators for policy decisions.

By publishing these dates well in advance, the Bank of Canada facilitates better planning and anticipation of potential market changes by investors, financial analysts, and the public. Stay tuned for these dates to understand the Bank’s view on the economy and to plan your financial moves wisely.

What does the Bank of Canada do?

The Bank of Canada is the country’s central bank, and its primary mission is to promote the economic and financial welfare of Canada. It has four main areas of responsibility:

- Monetary Policy: The Bank of Canada aims to preserve the value of money by keeping inflation low and stable. It sets the interest rate (also known as the ‘policy rate’) at a level that it believes will achieve an inflation target of around 2%. Changes in the policy rate influence other interest rates and affect the behavior of borrowers and lenders, thus impacting spending and, ultimately, inflation.

- Financial System: The Bank of Canada promotes a safe, sound, and efficient financial system. It oversees key financial systems, provides liquidity facilities, and carries out functions to support the stability of the Canadian financial system.

- Currency: The Bank designs, issues, and distributes Canada’s banknotes. It also strives to keep counterfeiting levels low and works to ensure that Canadians have confidence in their banknotes.

- Funds Management: The Bank of Canada acts as the ‘fiscal agent’ for the Government of Canada, managing its public debt programs and foreign exchange reserves.

The Bank also conducts research and analysis on economic and financial relations, developments and trends, and it communicates its objectives, actions, and analysis to Canadians and market participants transparently.