The New Advanced Canada Workers Benefit (ACWB) Payment will start rolling out to eligible Canadians on July 12, 2024, by the Canada Revenue Agency (CRA). The previous payment was sent on January 12, 2024.

The Advanced Canada Workers Benefit (ACWB) is a program by the Canadian government to provide financial support to low-income workers and families across Canada.

The amount of the ACWB payment depends on the amount you are eligible for under the Canada Workers Benefit (CWB).

The Canada Workers Benefit (CWB) has two parts: a basic amount and a disability supplement.

You can apply for the CWB when you submit your income tax return.

Jump to:

What is Advanced Canada Workers Benefit?

If you qualify for the Canada Workers Benefit, you can receive up to 50% of your CWB in advance through the Advanced Canada Workers Benefit (ACWB).

Similarly, if you’re eligible for the disability supplement, you’ll receive 50% of that amount along with your basic advanced payments.

To be eligible for these advanced payments, you need to be a resident of Canada at the beginning of the quarter.

You can estimate the amount you’re entitled to receive in advance by using the Child and Family Benefit Calculator.

Please ensure that you input your information accurately, reflecting your situation as of December 31, as stated in your income tax and benefit return.

People who qualify can expect to get the money around July 12, 2024. But it might take up to 10 business days to show up in their CRA-linked bank account.

The new automatic advance CWB payment will make life more affordable for Canadians who need it most, along with other benefits and measures to reduce inflation.

Who is Eligible for Canada Workers Benefits (CWB)?

The Canada Workers Benefit (CWB) is available depending on your income and situation. Here’s a quick look at who is eligible to get this help.

CWB Basic Benefit Eligibility

You are eligible for Canada Workers Benefits (CWB) if:

- You earn income from a job and make less than a certain amount, determined by your province or territory

- You live in Canada all year

- You must be at least 19 years old by December 31, or live with your spouse, common-law partner, or child.

You are not eligible for the CWB if:

- You’re a full-time student at a designated educational institution for more than 13 weeks in the year, unless you have a dependent.

- You’re in prison for at least 90 days during the year.

- You don’t pay taxes in Canada because you work for another country as a diplomat or you’re related to or work for a diplomat.

Who is an Eligible Spouse or Partner?

Your spouse or partner is eligible for CWB payment if they:

- Live with you by December 31

- Live in Canada all year

Your spouse or partner isn’t eligible for the CWB if they:

- Are a full-time student at a designated educational institution for more than 13 weeks in the year, unless they have a dependent child by December 31

- Spend 90 days or more in prison during the year

- Don’t pay taxes in Canada because they work for another country as a diplomat or they are related to or work for a diplomat.

Who is an Eligible Dependent?

To qualify for the CWB, a dependent must fulfill the following criteria:

- Be your child, your spouse’s, or your common-law partner’s child.

- Be under 19 years of age and residing with you on December 31.

- Not be eligible for the CWB themselves.

Disability Supplement Eligibility

You could get the disability part of the CWB if you:

- Can get the disability tax credit and have an approved Disability Tax Credit Certificate (Form T2201) with the CRA

- Make less than a certain amount, which is set by your province or territory

How much you can get from Canada Workers Benefits (CWB):

Maximum Basic Amount for the Canada Workers Benefit (CWB):

Single Individuals:

- For single individuals, the maximum basic amount is $1,428.

- This amount is reduced gradually if your adjusted net income exceeds $23,495.

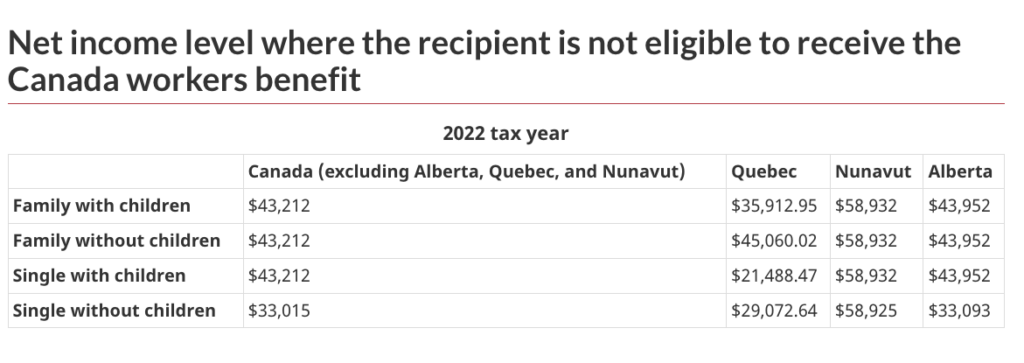

- No basic amount is paid if your adjusted net income surpasses $33,015.

Families:

- For families, the maximum basic amount is $2,461.

- This amount is also gradually reduced if your adjusted family net income is more than $26,805.

- No basic amount is paid if your adjusted family net income exceeds $43,212.

It’s important to note that the maximum basic CWB amount may vary for residents of Quebec, Nunavut, and Alberta.

Maximum Amount for the CWB Disability Supplement:

Single Individuals:

- The disability supplement maximum amount is $737 for single individuals.

- This supplement is reduced gradually if your adjusted net income exceeds $33,018.

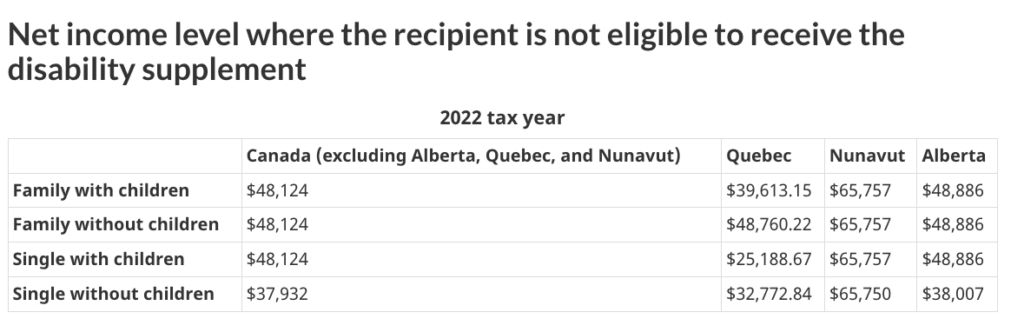

- No supplement is paid if your adjusted net income is more than $37,932.

Families:

- For families, the CWB disability supplement is also $737.

- It decreases gradually if your adjusted family net income is more than $43,210.

- Additionally, no supplement is paid if one spouse is eligible for the disability tax credit and your adjusted family net income exceeds $48,124.

Similarly, if both spouses are eligible for the disability tax credit and your adjusted family net income surpasses $53,037, no disability supplement is paid.

It’s important to note that the maximum amount for the disability supplement may vary for residents of Quebec and Nunavut.

Calculation of CWB Refundable Tax Credit:

The Canada Revenue Agency (CRA) calculates your CWB refundable tax credit based on several factors:

- Marital status and eligibility of spouse

- Province or territory of residence

- Earned working income

- Adjusted family net income

- Eligible dependant

- Eligibility for the disability tax credit

How CRA decide who gets advanced payments for married or common-law spouses?

Determining who gets the advanced payments for married or common-law spouses is based on a few simple rules.

Only one spouse gets the advanced payments for the whole family.

If neither spouse qualifies for a disability supplement:

- The spouse with the higher working income will receive the basic advanced payment for the family.

- If both spouses have the same working income, the first person who filed will get the basic advanced payment.

If one or both spouses qualify for a disability supplement:

- Suppose you and your spouse are both eligible for advanced payments and one of you is eligible for the disability tax credit. In that case, the person with the disability will receive the basic advanced payment for the family and their disability supplement.

- If both of you qualify for advanced payments and the disability tax credit, only one of you will receive the basic amount for the family. However, each of you will receive your own disability supplement.

How to Apply for the Canada Workers Benefit (CWB)?

To apply for the CWB, you can follow one of two routes:

- Online Application: Follow the instructions given by your certified tax software.

- Paper Application: Complete and submit Schedule 6, Canada workers benefit.

To qualify for the disability supplement, you must claim both the base credit and the disability supplement when filing your income tax.

Canada Worker Benefit Payment Schedule:

The 2024 CWB payments will be distributed on the following dates:

- July 12, 2024

- October 11, 2024

Didn’t Receive Your Payment?

If you don’t receive your CWB, first check your eligibility. If you’re eligible but haven’t received your payment, contact the Canada Revenue Agency (CRA). Be sure to wait at least 10 business days before contacting the CRA about a missed payment.